Eliminate manual intervention and ensure zero underwriting errors with the auto underwriting rule engine. Meet regulatory requirements and adapt to dynamic business needs with our configurable solution. Automate end-to-end policy issuance process, deliver superior user experience, and ensure a shorter prospect to customer lifecycle.

Features of Newgen Policy Issuance and Underwriting Software

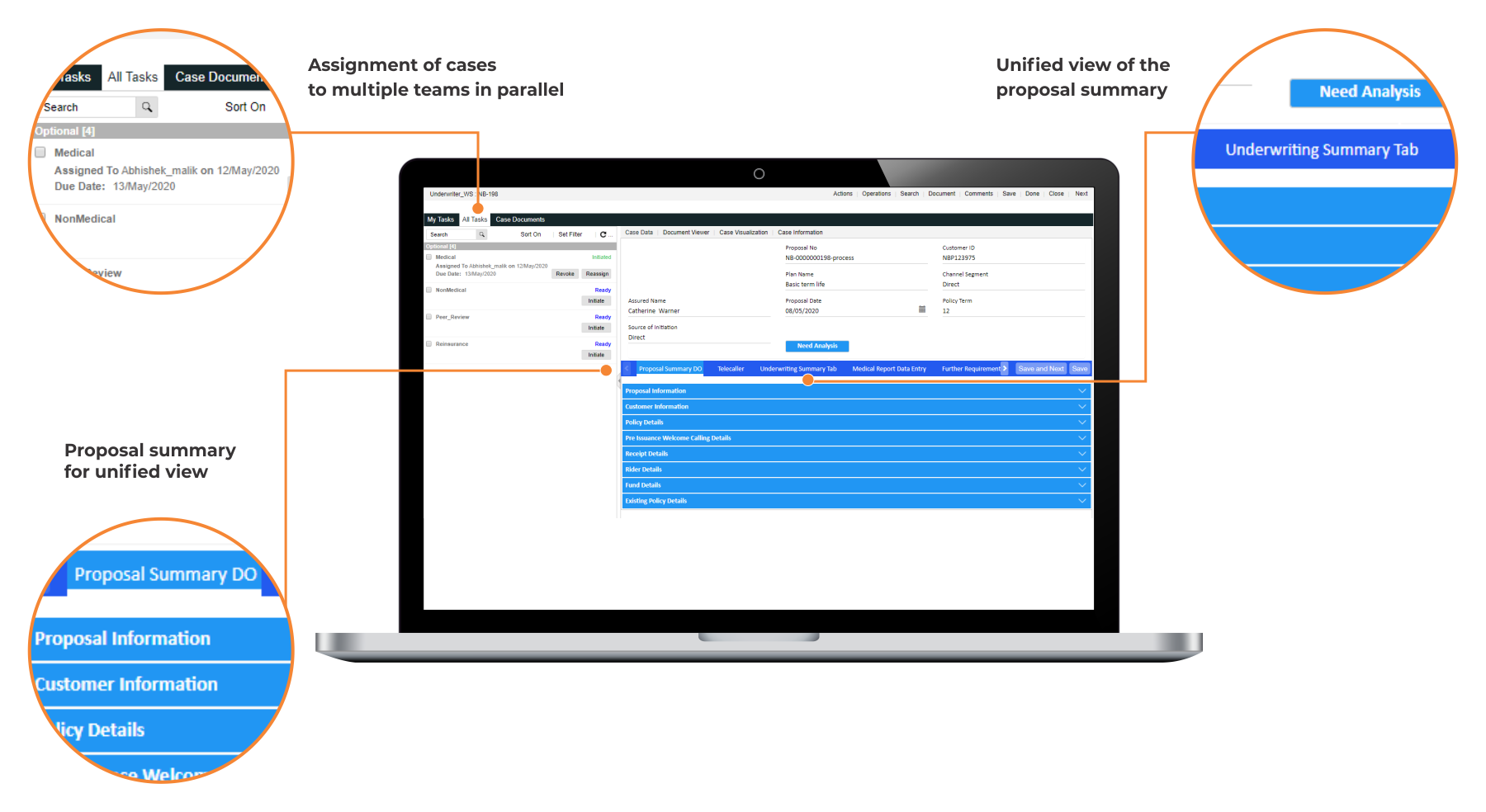

Policy Elements and Underwriting Analysis

Configurable user interface to define data elements per specific requirements

Sophisticated dashboards for in-depth data analysis and report generation

Core Underwriting Engine

Dynamic rules to facilitate straight-through processing of low complexity submissions and automate key underwriting tasks

Abstract underwriting rules and complex logic are configured into the system

Flexibility to change rules according to dynamic business requirements

Underwriting Evaluation

Automatic policy evaluation to maximize the percentage of straight-through pass cases for quick policy issuance

Auto-classification of non-straight-through cases and routing of cases to underwriters based on the authority limit

Additional Information Capture

Access to comprehensive case details to ensure informed decision-making

Request capabilities for additional documents and information, based on medical or non-medical parameters

Integration and Personalization Capabilities

Seamless integration with third-party and legacy applications, such as policy administration, CRM, etc.

Omnichannel, personalized engagement across all channels, including mobile, web, in-person, chatbox, social, and bots

Brands using Newgen Platform

Success Stories

Join the Conversation

Solution Built On NewgenONE Platform for Insurance Firms

All You need to know about Insurance Claims Management

Claims management software is a type of computer program or platform designed to help organizations, particularly insurance companies, efficiently manage customers’ claims. The claims management software streamlines the end-to-end claims process, from initial submission to final settlement, by automating various tasks and providing tools for monitoring and tracking claims.

Claims automation refers to the process of using technology, such as artificial intelligence (AI), machine learning, and robotic process automation (RPA), to streamline and expedite the handling of insurance claims. The process involves automating various steps in the claims processing workflow, including submission of claims, validation, assessment, adjudication, and payment.

A claims processing system is a software application or a set of procedures used by insurance companies, healthcare providers, or other organizations to handle and manage insurance claims in an efficient manner. It involves the entire process, from the initial submission of a claim by a policyholder or a healthcare provider to the final resolution of the claim. This includes verifying the validity of the claim, assessing the coverage, determining the amount payable, and processing the payment to the claimant or provider.

Adjudication of a claim refers to the formal process of resolving a dispute or controversy regarding a claim made by one party against another. This process typically involves a neutral third-party—judge, arbitrator, or adjudicator—who reviews the evidence and arguments presented by both sides and renders a decision or judgment.

Content services play an important role in insurance claims management by facilitating efficient handling of documents, data, and communication throughout the claims process. Enlisted below are some of the key roles of content services in insurance claims management:

- Document management

- Workflow automation

- Data extraction and integration

- Collaboration and communication

- Compliance and security

- Analytics and reporting

- Customer experience

An efficient claims management process not only streamlines operations by minimizing claim denials and reducing billing errors but also expedites revenue cycles. Moreover, it serves as a safeguard against fraudulent activities, enhances patients’ satisfaction levels, ensures adherence with healthcare regulations, and mitigates legal risks.

Claims management is aimed at handling and resolving claims made by individuals or organizations against a company, insurer, government agency, or other entities. These claims can arise from various situations, including accidents, injuries, property damage, contractual disputes, or other forms of liability.

A claims management system (CMS) is a software application used by insurance companies, healthcare organizations, and other entities to streamline and automate the process of managing insurance claims. It helps in processing claims efficiently, tracking their status, and ensuring compliance with regulations and policies.

Claims management services are responsible for guidance and support, pertaining to seeking compensation, restitution, repayment, or any form of remedy for losses or damages, as well as assistance with fulfilling other obligations. These services extend to various aspects including litigation, participating in regulatory schemes, or engaging in voluntary arrangements.

Claims management is aimed at handling insurance claims, encompassing various steps to ensure that claims are processed efficiently and accurately. Here are the typical steps involved in claims management:

- Notification

- Claim documentation

- Claim review

- Coverage determination

- Claim settlement

- Payment processing

- Claim closure

- Review and analysis

- Subrogation (if applicable)

- Customer feedback

A customer reports a suspicious transaction to the bank. Customer service collects details and registers a claim. The bank investigates, either refunding if fraud is confirmed or explaining if the transaction is legitimate. The customer is kept informed across each step of the process. Feedback is collected for improvement.